The value of some assets like stocks and mutual funds is straightforward because they are bought and sold frequently. Ideally, we’d need to know how much value her investments gained. Unlike wages, capital gains are harder to calculate – and harder to tax. the power to tax incomes “from whatever source.” The IRS needs to know how much money a taxpayer makes in a year in order to tax her properly under the 16th amendment, which was ratified in 1913 and gave the U.S. Among the top 1 percent, however, capital gains make up 36 percent of total income. Most Americans get the vast majority of their income from wages and salaries. Income can also come from the appreciation of non-cash assets such as stocks and real estate, also known as capital gains. But financial resources don’t always come in the form of cash. In economics, a person’s income in a given year should include all inflows of new financial resources that can be used for either consumption or gains in net worth.Ī familiar example is your paycheck. Use the Capital Loss Carryover Worksheet in Publication 550, to figure the amount carried forward.ġ IRS Topic 409, Capital Gains and Losses. If your net capital loss is more than this limit, you can carry the loss forward to later years. If your capital losses exceed your capital gains, the amount of the excess loss that can be claimed is the lesser of $3,000, ($1,500 if you are married filing separately) or your total net loss as shown on line 16 of the Form 1040 Schedule D, Capital Gains and Loses. Hence, it is possible that an individual’s federal tax on capital gain could be as high as 23.8% (20% + 3.8% NIIT). Unrecaptured § 1250 Gain, (gains on real property attributable to straight-line depreciation).Įffective for year 2013 and after, the Health Care Act of 2010 imposed an additional 3.8% net investment income tax (NIIT) on certain individual’s investment income. Section 1202 qualified small business stock. The following are the income thresholds for 15% and 20% rates. Taxpayers with income below the 15% rate threshold below, pay 0%. The table below indicates capital gains rates for 2018. Refer to IRS Publication 505, Tax Withholding and Estimated Tax, for additional information. If you have a taxable capital gain, you may be required to make estimated tax payments. The part of any net capital gain from selling Section 1250 real property that is required to be recaptured in excess of straight-line depreciation is taxed at a maximum 25% rate. Specifically, for individual taxpayers, gross income does not include 50% of any gain from the sale or exchange of “qualified small business stock” held for more than 5 years.

#Capital gain 2017 code#

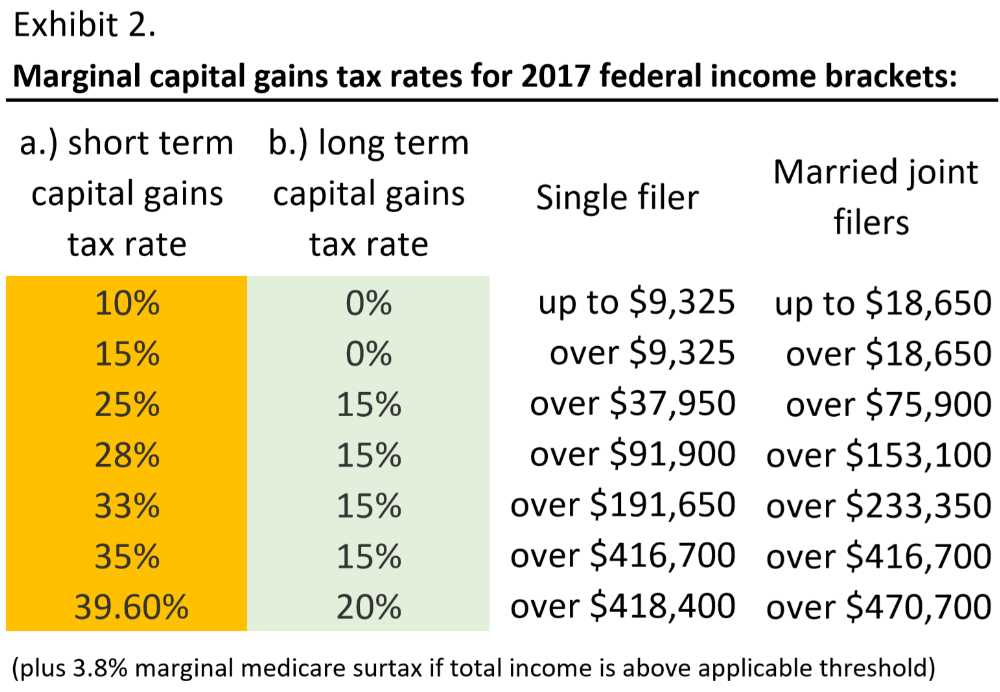

The taxable part of a gain from selling Internal Revenue Code Section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate. Capital gains rates for individual increase to 15% for those individuals with income of $38,600 and more (($77,200 for married filing joint, $38,600 for married filing separate, and $51,700 for head of household) and increase even further to 20% for those individuals with income over $425,800 ($479,000 for married filing joint, $239,000 for married filing separate, and $452,400 for head of household). Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed at 0%. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than the sum of your net short-term capital loss and any long-term capital loss carried over from the previous year. If you have a net capital gain, that gain may be taxed at a lower tax rate than the ordinary income tax rates. Ĭapital gains and deductible capital losses are reported on Form 1040.

#Capital gain 2017 free#

Get all the numbers you need at your fingertips with our free 2018 desktop reference. If you hold it one year or less, your capital gain or loss is short-term.Ĭapital gains rates, individual and corporate tax rates, deductions/exemptions, and more. If you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. Losses from the sale of personal-use property, such as your home or car, are not deductible.Ĭapital gains and losses are classified as long-term or short-term. You have a capital loss if you sell the asset for less than your basis. You have a capital gain if you sell the asset for more than your basis. When a capital asset is sold, the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital loss. 1 Examples are a home, household furnishings, and stocks or bonds held in a personal account. Almost everything owned and used for personal or investment purposes is a capital asset.

0 kommentar(er)

0 kommentar(er)